Enverus, an energy-dedicated, software-as-a-service company that leverages generative artificial intelligence across its solutions, has released its 2025 Interconnection Queue Outlook, a comprehensive collection of power generation and transmission projects that show requests to connect to the U.S. power grid.

Through leveraging its proprietary machine-learning model, Enverus assigns a probability of success to every queued power plant project, enabling the analysis of trends and insights into portfolio valuation and queue dynamics. With interconnection queue challenges posing a major hurdle for projects, this outlook offers a data-driven perspective and provides critical insights for developers, investors and policymakers navigating the evolving energy landscape.

Ryan Luther, research director for Enverus Intelligence Research (EIR), said, “The queue outlook reflects numerous factors, and ISO [independent system operator] activity will continue to be a focus for developers, IPPs [independent power producers] and investors driving the future of energy.”

Enverus experts continue to underscore that generous tax credits from the Inflation Reduction Act and the Environmental Protection Agency’s update to 40 CFR Part 60, which mandates additional coal-fired power plant retirements, have significantly boosted demand for renewable energy projects across the U.S. The surge in investment and development has overwhelmed interconnection queues, with a record number of projects seeking grid connections. This has exceeded grid operators’ processing capacity, causing significant delays and project suspensions. Understanding project suspensions and success rates is critical, as these factors vary by independent system operators (ISOs), technology type, and project stage.

“Understanding project suspensions and success rates is critical, as these factors vary by ISO, technology type and project stage,” said Luther. “Low success rates have prompted policy interventions like FERC Order 2023 to streamline interconnection queues, but delays and suspensions persist due to regulatory hurdles, permitting delays and supply chain disruptions.”

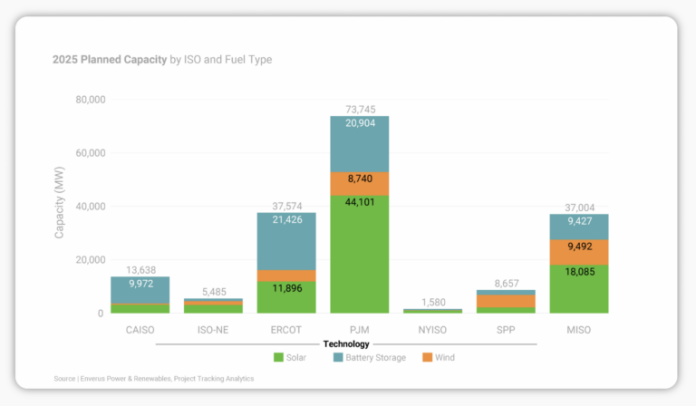

Backlog of Renewable Energy Projects

Analysts in a recent EIR report found about 90% of renewable generation projects do not progress beyond the interconnection queue, and that the New York ISO (NYISO), Southwest Power Pool (SPP), Pennsylvania-New Jersey-Maryland (PJM) and ISO New England (ISO-NE) have higher suspension rates later in the project lifecycle, with Interconnection Agreement suspension rates ranging from 46% to 79%, compared to around 20% in Electric Reliability Council of Texas (ERCOT), California Independent System Operator (CAISO), and Midcontinent Independent System Operator (MISO). Projects in these markets show minimal improvement in completion probability until reaching construction. Understanding these regional differences helps developers maximize investment potential by minimizing project delays and increasing the odds of making it through the queue.

“Congestion, competition, aging infrastructure and interconnection bottlenecks are the biggest obstacles in the way of reaching our goal of siting projects, maximizing the production of renewable energy generators and delivering power where it’s needed the most,” said Silvia Alborghetti, director of Business Development at zhero, a developer of large-scale clean energy infrastructure. “But the information we need for project siting requires lots of resources and time to gather.”

Enverus with its interconnection queue data provides a comprehensive view of key variables, including asset economics, power demand growth, existing and planned transmission lines, and substation-level available transfer capability, among other information.

Enverus recently acquired Pearl Street Technologies, a company that works with transmission providers, project developers, policy advisors and others in the energy space. The acquisition brings additional capabilities to gathering interconnection information. Through the Interconnect system, users can generate injection capacity maps, run shadow studies, evaluate cost allocation scenarios and assess interconnection risks, all in house and in hours, to guide decision-making and steer more projects to interconnection success.

“Quick analysis is a competitive advantage, especially when we receive proposals from different sources of land originators who aren’t going to wait long on our decision,” saids Andrea Braccialarghe, president and CEO of zhero. “Enverus provides the diverse data in one place we need for quantitative and qualitative analysis for our leadership team to make a decision about investing in specific areas.”

Key challenges identified in the 2025 Interconnection Queue Outlook include:

- Compounding delays across several stages were the main driver of CAISO’s higher-than-average project development timelines, which averaged close to eight years for all project types. ISO-NE had the shortest development timeline, averaging nearly 3.6 years to reach operation, followed by ERCOT at about 4.2 years.

- NYISO, SPP, PJM and ISONE have more suspensions later in the project lifecycle, with Interconnection Agreement suspension rates ranging from 46% to 79%, compared to around 20% in ERCOT, CAISO and MISO. Consequently, projects in these markets show minimal improvement in completion probability until reaching construction.

- Only a fraction of capacity in the interconnection queues are expected to reach operation. Based on Enverus’ gradient-boosting machine learning model, only ~10% of projects will successfully come online in the next three years.