The net-zero transition will disproportionately impact regions that are or have been heavily dependent on the extraction, processing, and concentrated use of coal, oil, and natural gas. To ameliorate this the Inflation Reduction Act offers up to a 10% tax credit adder for projects within designated “energy communities” that will face challenges from the transition away from fossil fuels. The available tax credit is increased by an additional 10% if prevailing wage and apprenticeship requirements are met or 2% if those requirements are not met for projects over 1 MW. Privately owned residential projects do not qualify for the energy community bonus, but they do qualify if part of a commercial portfolio.

The IRA defines energy communities based on three possible criteria: brownfields, coal communities, and tax and job revenue. Locating and taking advantage of these three types of energy communities will be integral for renewable energy developers. LandGate, a leading provider for data solutions and an online marketplace for US commercial land and resources, recently published a guide for profiting from these energy communities using their PowerData tool.

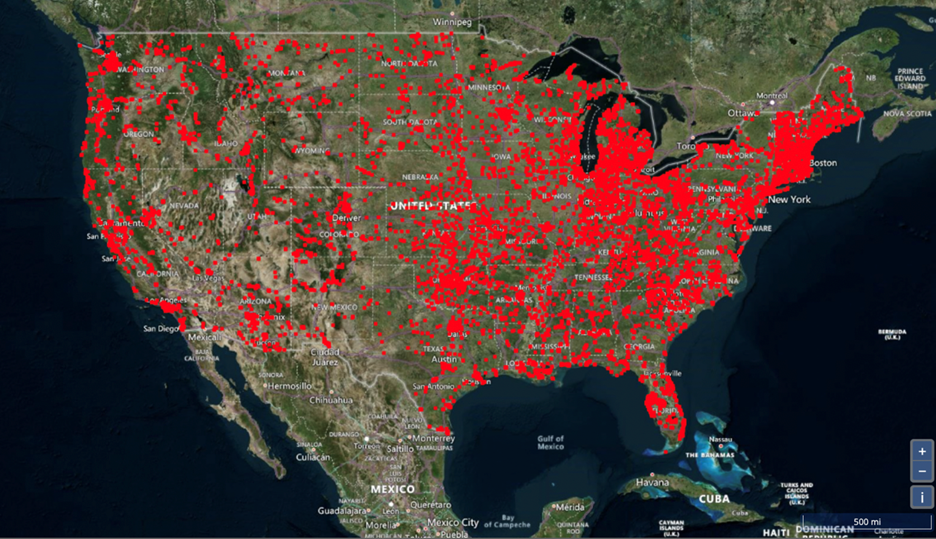

Brownfields are sites with environmental contamination as defined in the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) of 1980 and designated by the EPA. While these sites are typically smaller, this designation allows for additional funding for redevelopment and cleanup. Programs like the EPA’s RE-Powering Initiative, and Massachusetts’ SMART solar incentive have already assisted this effort.

Image: Landgate

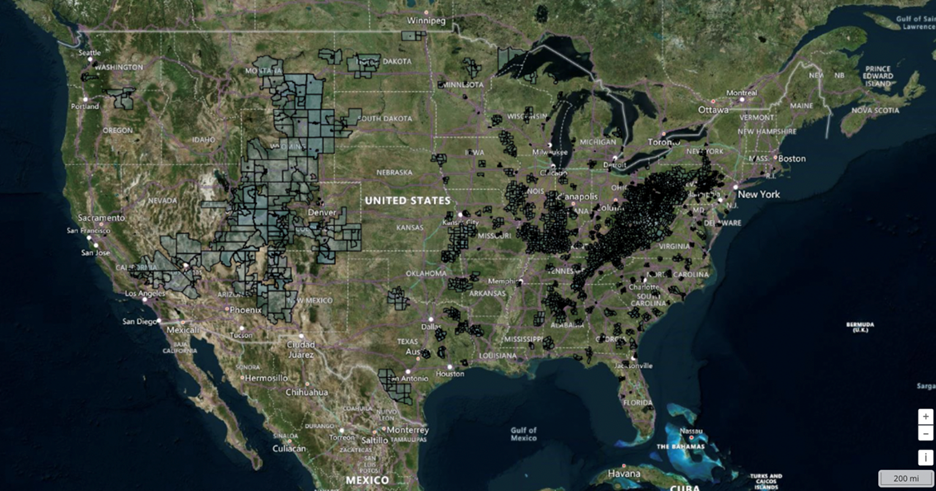

Coal communities are defined as a census tract, and any adjoining tracts, which has at any point after Dec. 31, 2009, had significant employment or local tax revenue related to the extraction, processing, transport, or storage of coal, oil, or natural gas. A census tract with a coal mine closed after Dec. 31 1999 or a coal-fired electric generating unit retired after Dec. 31, 2009, is also eligible. These tracts cover about 20% of the overall area of the United States, as seen below. Developers will be paying particular attention to this as building new solar projects is already less expensive than operating existing coal plants, according to a report from Energy Innovation Policy & Technology.

Image: Landgate

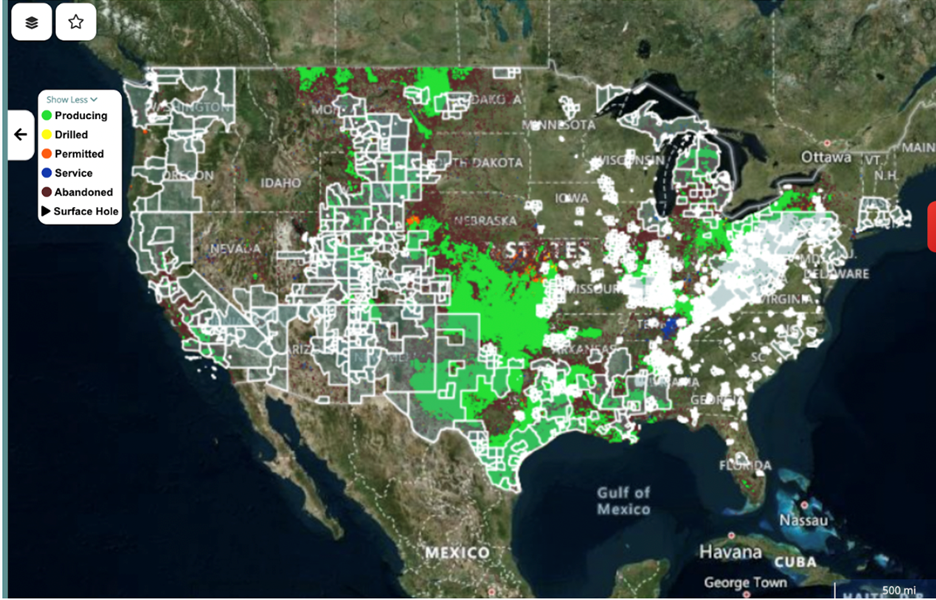

The IRA defines a third case for a metropolitan or non-metropolitan statistical area that meets criteria on tax and job revenue. The area must have both an unemployment rate at or above the national average for the previous year and 0.17 percent or greater direct employment or at least 25 percent of local tax revenues related to the extraction, processing, transport, or storage of coal, oil, or natural gas. As seen below, the light green area represents regions with at least 0.17% fossil fuel employment along with an above-average rate of unemployment. This covers about 39% of the total US area but further clarification is anticipated from the Department of Treasure and Energy as unemployment rates vary over time.

Image: Landgate

Image: Landgate

Further clarification is also required for defining areas where at least 25% of local tax revenue is provided by fossil fuels. Most local governments do not currently publicly publish their tax revenue for infrastructure or fossil fuel related facilities. Instead, LandGate offers access to data for fossil fuel resources to estimate the associated local tax revenue. While further clarity is required for some of these broad definitions, energy communities will define the playbook for solar developers looking to maximize incentives in the years to come.